Financial advice delivery and execution all in one place

The future of advice technology

What if you could have seamless integration?

Client data flow

Your Advice Software

What if you could go from your advice document straight into advice implementation?

Unlocking the power of next-generation wealth management

We prioritise the success of both clients and advisers by providing a cutting-edge wealth platform that revolutionises investment execution. Our investment platform delivers a host of benefits, including increased efficiencies, reduced cost of advice, and flexible portfolio management options, such as MDAs, managed accounts, and transparent low-cost superannuation.

Wealth Simplifier

Grow your wealth using a low cost, transparent and flexible investment platform that provides you with easy access whenever you need it via a Client Portal.

HIN-Based

The client owns all their assets in their own name.

Automatic ROA to Market Trades

Electronic signing of the recored of advice (ROA) document for more timely abd mobile access.

Scalable portfolio tailoring

Use individual client rules to provide best treatment - Get the most of out of your investment.

Super Simplifier

Manage clients’ super assets in a low cost, managed account client centric technology which allows for maximum portfolio flexibility.

About the Investment Platform

Auto-rebalancing at your fingertips

Rebalancing your clients’ portfolios shouldn't be your biggest burden, it should be one of your biggest value adds!

DASH Platform allows you to easily identify all of your clients’ portfolios that are sitting outside their risk profile and tolerances, and then rebalance them all in bulk. Our bulk auto-rebalance functionality is one of many ways that DASH investment and super platforms puts you in control while automating the legwork.

MDA or ROA - the choice is yours to make for each of your clients. You can filter which clients you want to handle personally and send the rest their ROA via DocuSign (no DocuSign license required).

Trades are executed automatically, intra-day upon acceptance of authority to proceed. Reminders are also sent to your clients if they haven’t signed yet.

Introducing the DASH Client Portal

We understand the importance of providing your clients with a seamless and dynamic portfolio reporting experience. Our native Android and iPhone application offers a clean and nimble interface, ensuring your clients can effortlessly navigate, track, and access all their investments in one centralised location.

Discover the benefits of our Client Portal:

All-in-one portfolio management solution: Our Client Portal serves as a comprehensive portfolio management solution, consolidating all investment information into a single, user-friendly platform. Say goodbye to scattered reports and cumbersome spreadsheets – with DASH, your clients can access a holistic view of their portfolios with ease.Effortless navigation and tracking: Our intuitive interface makes it a breeze for clients to navigate through their investments. They can effortlessly track the performance of individual assets and gain valuable insights into their overall portfolio health.

Up-to-date secure portfolio access on your mobile: We understand the need for real-time information in today's fast-paced world. With our Client Portal, your clients can enjoy secure, up-to-date access to their portfolios anytime, anywhere, directly from their mobile devices.

Direct communication with advisers: Foster a strong client-adviser relationship with our Client Portal's built-in communication features. Clients have the ability to directly interact and communicate with their advisers. This seamless connection ensures transparency, trust, and a superior client experience.

Model Managers

DASH supports financial advisers by providing access to both the assets that are in best interests of the client as well as specialists in investment management who provide models and research and investment committee participation.

Our Model Manager and Asset consultants provide these services to advisers using DASH services.

Best of Breed MDA Investment Series

Bringing a professional overlay to your client experience.

At DASH we are focused on making your life easier and putting advisers and their clients’ first. If you don’t want to build your own models, we’ve brought together the who is who in managed accounts to do it for you!

Investment solutions

Our comprehensive wealth management solutions offers features such as portfolio management, financial planning tools, and performance reporting, empowering financial advisers to deliver personalised advice and holistic financial solutions.

Advanced technology also enables efficient client communication and collaboration, allowing you to stay connected with your clients, share real-time information, and provide timely updates on portfolio performance.

Looking to handpick your tech stack from best of breed vendors?

Start your journey with cutting-edge solutions

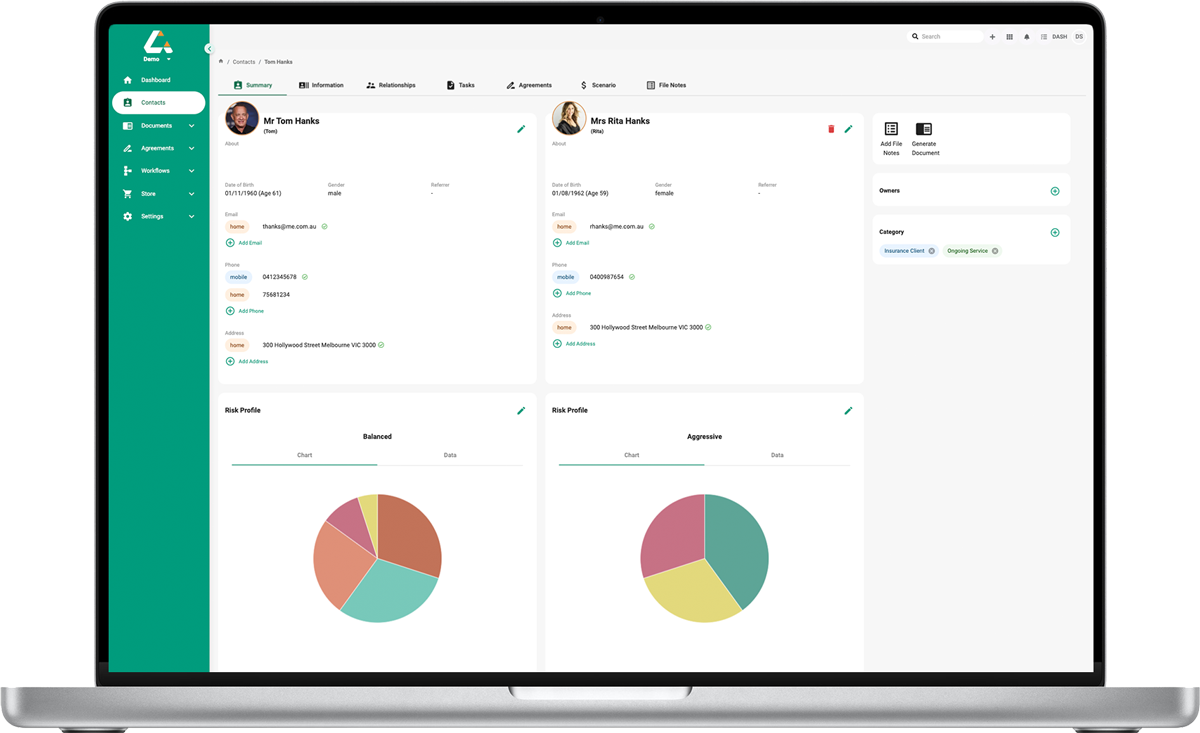

CRM

Manage your client details, agreements, practice tasks and workflows all from the one place.

Discover the benefits of the Advice Marketplace

True connectivity

Say goodbye to siloed applications and fragmented workflows.

True connectivity

Say goodbye to siloed applications and fragmented workflows. The Advice Marketplace seamlessly integrates your preferred applications, ensuring true connectivity across your advisory ecosystem. Streamline your processes and enhance collaboration like never before.

Comprehensive solutions

From fact finding and modelling to statement of advice (SOA) generation, the Advice Marketplace covers the entire advice process.

Comprehensive solutions

From fact finding and modelling to statement of advice (SOA) generation, the Advice Marketplace covers the entire advice process. Our platform offers a range of robust solutions, including CRM, workflow management, and document generation capabilities. Simplify your operations and maximise your efficiency.

Talk to us to enhance your digital advice delivery

Harnessing innovation for enhanced client satisfaction

Meet James Gerrard, the visionary behind www.financialadvisor.com.au, dedicated to delivering quality financial advice to more Australians. With a strong focus on innovation, James has successfully propelled his business forward, providing efficient and effective services to his growing client base.

Read more